“Inflation and its perils.”

The Fed’s still clueless. The 99 percent will pay for it.

Even though this year’s annual gathering of central bankers and scholars didn’t take place near the dramatic backdrop of the Tetons, Federal Reserve Chairman Jerome Powell’s virtually delivered speech points to a mountain of trouble ahead for the U.S. economy. And the chairman himself is part of the problem, which makes a cure even more problematic.

Diagnosing a sickness is a prerequisite for recovery. But it’s clear that Powell remains clueless. He’s operating from a flawed playbook and therefore misdiagnoses the risks posed by rising inflationary pressures, which he continues to think are transitory phenomena—global supply chain disruptions, renewed Covid–19 outbreaks—as against underlying conditions in the labor market that would indicate a more long-lasting problem.

Powell also fails to realize that the institution he heads is another big part of the problem: Decades of political dysfunction have led to a policy vacuum into which the Federal Reserve has stepped, often with calamitous results. Because we entrust such momentous responsibility to a small group of unelected central bankers, we should at least expect they would maintain a cautious approach to monetary management, especially after the calamities of 2008. Their decisions can cause great harm, so they should act accordingly.

But most central bankers today, Powell included, are suffering from massive policy overreach and hubris. He says the most unimaginable things, such as central bankers must “unlearn” everything they ever thought they knew about the history of financial crises. He also has some rather questionable ideas about money and inflation.

In the speech itself, Powell indicated that the central bank was likely to begin “tapering” before the end of the year—a fancy word to suggest that it would be winding down its bond-buying operations, which many investors considered a major factor in sustaining prevailing low interest rates. The last time a Federal Reserve chairman announced that he planned to curb the pace in bond buying operations—Ben Bernanke back in 2013—it created a collective reactionary panic that triggered a spike in Treasury yields, the so-called “taper tantrum.”

With that in mind, Powell quickly reassured the markets that rate hikes weren’t imminent, as there was still “much ground to cover” before the economy hit full employment. The dovish rhetoric clearly had a soothing effect on markets, as the dollar weakened, and bond yields declined in response to the speech.

All good, right? After all, aren’t these low rates necessarily to sustain economic recovery? Not so fast.

We think there is increasing evidence to support the thesis we first expressed in June—namely, that labor shortages are multiplying, and the economy is increasingly rife with stories of businesses, particularly in the leisure and service industries, that are having difficulty attracting people back to work despite offers of significantly higher wages.

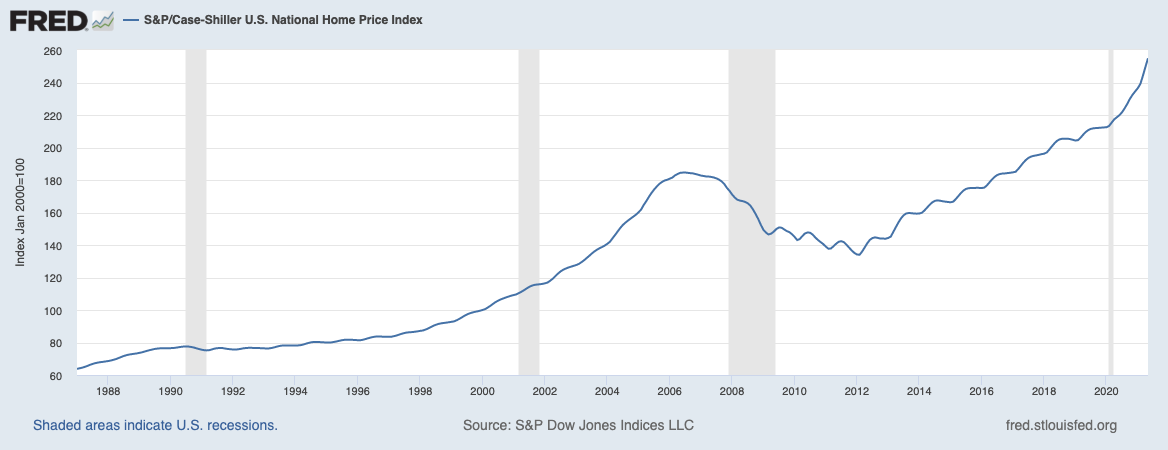

This puts America’s economic policymakers in a profoundly difficult position. Housing affordability remains a real problem, and even with the recent wage gains achieved via a tighter labor market, in real terms, these gains are being eroded by rising inflation (now running in excess of 5 percent annualized), adding yet another burden to America’s middle and working classes. And given America’s still extreme income inequality, any sustained rise in inflation will still disproportionately impact the majority of voters in this country, who have yet to experience anything remotely close to the benefits that have been achieved by the nation’s top tier, the 1percenters, who can easily adjust to rapidly rising prices in a way that the rest of us cannot.

At the same time, were the central bank to respond by raising interest rates, it could have catastrophic consequences, given the unprecedented levels of private debt now pervasive in the U.S. economy.

A core problem continues to be the absence of reliable data that would enable America’s fiscal and monetary authorities to gauge the optimal policy response going forward. Instead, there is a mass of contradictory data. Continuing unemployment claims, which tally the number of people who have already filed an initial claim and who have experienced a week of unemployment and then filed a continued claim for that week of unemployment, still record a pandemic-period job loss of 11 million. That would imply that there is a huge surfeit of labor all set to come back into the job market, thereby depressing wage growth and curbing incipient inflation.

On the other hand, the latest data from the Job Openings and Labor Turnover Survey program, which produces data on job openings, hires, and separations, and the most recent surveys from the National Federation of Independent Business both show a further surge in job openings despite the payroll data, which show a very large increase in employment.

We will stick with our earlier-expressed hypothesis that there have been many diverse people collecting unemployment insurance benefits, including working people paid in cash under the table. These have not been reported as job holders by either firms responding to payroll survey inquiries or by people responding to the Bureau of Labor Statistics household surveys.

As we noted earlier, the continuing rise of currency in circulation looks extremely anomalous in a pandemic environment, wherein people would be more inclined to minimize contamination risks by using electronic payments via credit cards and the like. Currency in circulation should have fallen; it has risen, and by a large amount. And it continues to rise. We believe this phenomenon is explained by workers “double dipping,” which would cause the BLS to understate the level of employment and overstate job losses since February 2020.

Another supporting factor is that the tight labor market is apparent even in red states where supplementary Covid relief support packages were withdrawn—this in as many as 25 states in June—yet labor market conditions remain tight in those jurisdictions as well. All of which would suggest that rather than contributing to an increased supply of labor, we’re simply seeing underground-economy workers re-emerging in to the above-ground official economy.

Despite strong job growth over the past couple of months, the labor shortages are not being alleviated. The latest BLS data simply reflect a statistical shift that is resolving the apparent contradictions in earlier reported labor data. But it is not alleviating the underlying economic reality – namely that there are about 1 million more job openings than people looking for work.

Powell nonetheless signaled that monetary policy would remain relatively easy. He indicated a reticence anytime soon to start raising the central bank’s benchmark short-term rate, the fed funds rate, now at 0.25 percent, which the Fed has kept close to zero since the pandemic tore through the economy in March 2020.

Why is that, given mounting inflationary pressures and ongoing labor market tightness?

One possible reason is the massively high level of prevailing private debt. Last year, DB Global Research provided an estimate that roughly 18 percent of U.S. companies could be classified as “zombies”—that is, businesses that do not make enough to service their debt interest and so can survive only through constant injections of new credit.

Research on interest rate coverage from the Bank of International Settlements, the central bankers’ central bank, and various other (paywalled) research by firms such as Bianco Research, all point to an inexorable rise of zombie companies in the U.S. economy. The number is much higher now than in 2007 despite a halving of interest costs and an overall higher average profit rate. In other words, the last major financial crisis we had back in 2008 failed to engender the kind of significant debt retrenchment and deleveraging that one normally sees in the aftermath of a financial crisis.

Private debt levels remain exorbitant today. Estimates based on the Fed’s own data at yearend 2020 suggest that total business debt was around 85 percent of GDP and total private sector debt was 164% of GDP. Richard Vague, author of A Brief History of Doom, and a chronicler of major world financial crises, has developed a “worst case” estimate showing that these figures might be as high as 104 percent and 184 percent respectively. Market analyst Frank Veneroso has an even more extreme estimate: He believes that business debt is 170 percent and total private debt 240 percent of GDP.

Regardless of which of these is correct, they are all ominous and place the U.S. central bank in an invidious position. High private debt levels imply a high degree of financial fragility, yet inflationary pressures today are the strongest we’ve seen in years. Asset markets are conspicuously manic, and much of the labor market, as noted, faces the tightest conditions in decades. Complicating the Fed’s decision-making is the resurgence of the pandemic, a phenomenon that has confounded the Fed’s expectations that the economy and job market would be on a clear path to improvement by this fall. The delta variant could slow spending in such areas as air travel, restaurant meals, and entertainment.

One can therefore understand why Jerome Powell would wish these problems away as “transitory” and put off the day of reckoning for as long as possible.

But there is another consideration. Over the last 40 years, a prevailing feature of the American economy has been an increasingly small minority ensconced in a diminishing set of safe career paths or sufficient wealth not to bother worrying about that, and a majority living in persistent anxiety over the costs of health, housing, education, the quality of public services, and other formerly ordinary attributes of middle-class life. The solution to these problems truly lies in the province of fiscal policy, not monetary. Given the increasingly dysfunctional nature of American politics over the past 30 years, however, fiscal policy has remained hampered. The Fed, perhaps understandably, has sought to step into this policy vacuum via increasingly unconventional expansions of monetary policy. These measures have been problematic for a number of reasons, not the least of which is that they have tended to prioritize the interests of Wall Street over Main Street and ultimately exacerbated the very problems they ostensibly sought to alleviate.

Through its aggressive bailout and backstop policies, the Federal Reserve has become a serial creator of bubbles, thereby increasing the economy’s financial fragility as it sustains yet more zombie corporations and precludes proper resolution of prevailing high levels of private debt. It is almost axiomatic that when these bubbles burst, inequality and economic precarity tends to increase, as distressed sellers ultimate liquidate their assets to survive, many of which are opportunistically scooped up by the groups that have been the beneficiaries of the Fed’s expansiveness in the first place.

Properly engineered fiscal policy creates the potential to reduce inequality, enhance higher quality employment, and turn our economy toward one that generates income growth, rather than sustain a credit-based growth model. By contrast, aggressive monetary policy of the kind pursued by Jerome Powell (and most of his predecessors since the days of Alan Greenspan) merely engenders more financial bubbles that exacerbate today’s severe structural problems—economic and social.

Today, the productive capacity of the U.S. economy is being steadily eroded by the inexorable rise of a herd of corporate zombies. Similarly, businesses are working aggressively to reconstruct global supply chains to their pre–Covid state, which will neither enhance the quality of employment at home nor solve the problem the virus exposed—namely, the lack of resilience in our domestic economy, a lacunae that can be fixed only via properly constructed industrial policy (which again is the purview of Congress and the White House, not the Fed).

We’ve still got a long way to go to solve a multitude of problems. But Jerome Powell’s proposed “solutions” as expressed in his Jackson Hole speech provide no solutions at all. Rather they simply add to the stock of problems we face, rather than alleviate them. There appears to be no light at the end of the tunnel, except the light of the onrushing monetary overkill train that threatens to bring forth to more economic hardship in the years ahead.