“The force of historical decline.”

Is America capable of self-correction?

This is the first of a two-part series on the causes of America’s decline—economic, industrial, social, spiritual—and on the thinking of two prominent intellectuals who address themselves to remedies.

I do not believe that civilizations have to die because civilization is not an organism. It is a product of wills.

—Arnold J. Toynbee

What causes national and civilizational decline? Can such decline be reversed? Is the American empire, with its hundreds of overseas military bases, destined for the historical graveyard wherein lie the corpses of all the once-grand empires of the past?

The U.S. currently exhibits multiple signs of national senescence to state the obvious. On the domestic front, the decay includes: a failed response to the Covid–19 pandemic, a pandemic of prescription drug overdoses-and a grotesque judicial settlement protecting the perpetrators, a catastrophic drought in the western half of the country and catastrophic storms elsewhere, infrastructure decay, extreme income inequality, a rent-extracting healthcare system that is one of the worst performing in the Western world, and a hollowed out industrial base.

In terms of military and foreign policy, the decay has manifested in the form of a wave of technical impotence and imperial over-extension: most prominently, a $2 trillion, two-decade failure in Afghanistan, a failure to abide by the standards of a treaty intended to govern Iran’s nuclear programs (perversely leading to an acceleration of said programs), a $1 trillion failure in Iraq (ironically leading to the expansion of Iranian influence in Iraq), a $1.5 trillion expenditure on the ineffective F–35 fighter plane, being outclassed by Russian hypersonic missile technology, incessant, Sinophobic saber rattling, and, the most glaring example of American foreign failure, the emergence of an alliance among Russia, Iran, and China, induced in no small measure by hawkish American policies.

With all this in view, is it even possible America will prove an exception to the apparently inevitable force of historical decline? Does the U.S. face a real-world version of Galadriel’s test in J.R.R. Tolkien’s Lord of the Rings saga? Galadriel, an elf-like queen who is offered and resists the One Ring, a magical device that corrupts and eventually destroys any wielder, states: “I pass the test…. I will diminish, and pass into the West and remain Galadriel.”

What is our American “One Ring”? It is the myth of American exceptionalism, the assumption that we cannot fail, is it not? Is the consciousness of ourselves as humanity’s exceptions not the license we grant ourselves as we transgress every single one of the ideals that are—let us not miss this—the very basis of our claim to chosen-people status?

The phenomenon of national and civilizational decline has been examined by historians and intellectuals for centuries. The most prominent account of decline comes from English historian Edward Gibbon’s The History of the Decline and Fall of the Roman Empire. This six-volume work, published from 1776 to 1789, broadly attributed Roman decay to a decline in civic virtue and the influence of Christianity as it rose. Oswald Spengler, the German historian and philosopher active in the early decades of the last century, studied the life cycle of human societies and offered his thoughts in his two-volume The Decline of the West, published in 1918 and 1923. In Spengler’s view, there were two phases in human societies: a Culture phase, characterized by creativity and growth, and a decline phase of stifling practicality in lieu of creativity, which Spengler called the Civilization phase.

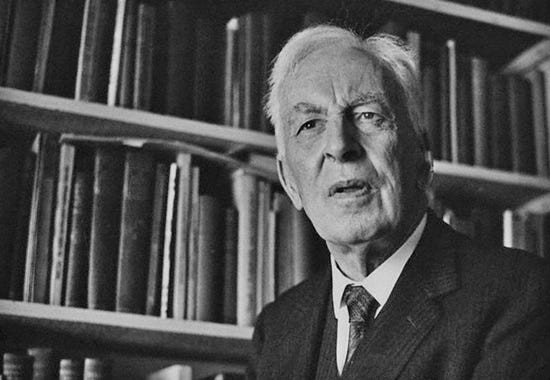

Arnold Toynbee, the noted British historian, devoted immense penmanship to the life cycles of human civilizations. A Study of History is a twelve-volume work written over three decades (1934–1961). In this vast endeavor, Toynbee developed a model to explain the beginnings and ends of civilizations. For Toynbee, growth is led by a creative minority and decline is caused by the inability of the creative minority to continue innovating. Philosopher Henri Bergson, we may note, had earlier explored the same themes in Creative Evolution and The Two Sources of Morality and Religion, his final two books.

It is stark to think about these men and their works while sitting in any American living room.

Gibbon, Spengler, and Toynbee provide descriptions of decline and explanations for it, but none of the three offers specific prescriptions for halting decline. (Only Bergson makes such an attempt.) In our time, however, there are two thinkers given to systematic design who have compelling, technically accomplished, and somewhat overlapping explanations as to the root nature of our 21st century decline. At the same time, each has proposed solutions that are, for the most part, in stark contrast to each other. These contemporary American thinkers are Professor James K. Galbraith, the progressive economist, and Peter Thiel, the venture capitalist and entrepreneur.

Professor Galbraith’s explanation of U.S. decline is nothing if not comprehensive. He finds the root cause in the economic sphere, generated by a set of interlinking factors. Galbraith accompanies his exploration of the economics of decline with a short set of measured, New Deal-style, risk-averse prescriptions for reversing it. All this is laid out in The End of Normal: The Great Crisis and the Future of Growth (Simon & Schuster, 2014), a work concerned primarily with the U.S. case.

Peter Thiel, a venture capitalist and billionaire, focuses on U.S. and (more broadly) Western decline. He, too, offers an economic explanation for America’s condition. Reflecting his background as a venture capitalist, Thiel’s thesis is rooted primarily in technological stagnation. But his proposal for reversing America’s decline transcends the economic and technological spheres to incorporate cultural and psychological considerations. This is a strength. It is a common error to treat economics as divorced from cultural, historical, and psychological considerations. It is Thiel’s move beyond economics that, I contend, will earn his solutions acceptance in lieu of Galbraith’s. However, simply because Thiel’s proposals are more likely to gain acceptance does not mean that Thiel will be able to deliver on his promises, as his proposed policies may end up killing the very host he is trying to save. Thielian policy alone will not work. For true success, Thiel needs synthesis with time-tested, Galbraithian market intervention.

While insufficient, what is the specific advantage that Thiel’s movement has? It lies in his resort to the scapegoat mechanism of Thiel’s intellectual mentor, the late Réne Girard.

Let us explore the analyses and proposals of Galbraith and Thiel, two formidable theorists in the Toynbee tradition, and consider carefully the insights of Réne Girard, the French social critic, historian, and philosopher, who professed at Stanford for many years before his death in 2015.

● ● ●

James Galbraith is a public intellectual with numerous articles and books to his credit on an impressive variety of topics. His investigations range from income inequality and financial corruption to militarism. Galbraith has argued in the past, notably in The Predator State: How Conservatives Abandoned the Free Market and Why Liberals Should Too (Free Press, 2008) that the U.S. government has been captured by oligarchs and has been repurposed from serving the public good to enriching said oligarchs. Assailing wealthy, powerful elites and fighting for the public purpose is a tradition that Galbraith inherits from his father, the late John Kenneth Galbraith, a prominent economist and Rooseveltian New Dealer. In this context, it may surprise those familiar with Galbraith père et fils that six years ago the younger man published The End of Normal, a pessimistic book about America’s poor growth prospects.

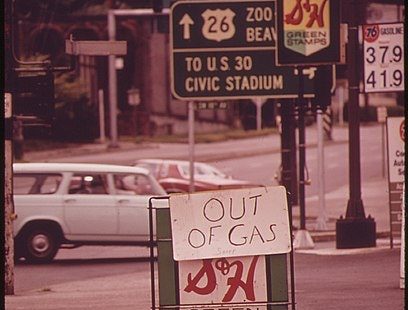

In Normal, Galbraith argues that there are four fundamental and interacting components to the economic decline of the U.S. The first is a choke-chain effect on economic growth, when demand for natural resources (primarily hydrocarbons) exceeds available supply. The Covid–19 crisis has altered this imbalance, but only temporarily, not structurally.

As is well-known, the U.S. emerged from World War II an undamaged industrial colossus relative to a devastated Western Europe and an exhausted Soviet Union. It was awash in its abundant oil resources and able to secure access to foreign resources by way of, among other things, the efforts of U.S. intelligence services. These factors allowed America to embark on a path of stable economic growth that endured until the first oil shock of the 1970s. But the scale and efficiency the U.S achieved due to these circumstances came with a tradeoff: The increase in economic size meant a larger proportion of total production costs would be fixed: expenses, such as infrastructure and pensions, that are inelastic because they are not dependent on the level of goods or services produced.

These fixed costs skyrocketed with the first oil shock (1973) and brought stable economic growth in the U.S. to a very abrupt halt. The two oil shocks, the second coming 1979, thus induced a period of economic uncertainty due to the decline of cheap, steady oil supplies. This was structural disruption, as against situational disruption, which is what the spread of Covid–19 faces us with today. Increased financialization and speculation characterized the economic system that evolved to cope with this reduction in opportunity for “honest profit.” Here we find the choke-chain effect: The shift toward finance capital inflated the price of scarce resources, so slamming the lid on future growth.

This transformation of the U.S. economy into a financialized/speculative mode is Galbraith’s second factor to explain U.S. economic decline. Here he considers the “financial casino” induced by the unstable nature of commodity prices and de-regulation. This, he argues, has resulted in chicanery not only in the commodities markets but also in the information-technology sector. Out of this came the dot.com crash in 2000 and subsequently the collapse of the once-stable U.S. mortgage market, which led to the great financial crisis of 2008. As Galbraith excellently puts it:

Fraud is a response, in short, to the failure of lenders to adjust to a decline in real possibilities.

The third of Galbraith’s decline factors is the changing nature of warfare. This leaves the once-preëminent U.S. military incapable of projecting power in a transformed geopolitical environment and securing dependable access to cheap resources (linking into the aforementioned factor of rising resource costs). Galbraith goes on to identify other shifts that render the U.S. military unable to conduct war effectively: the increasingly urban nature of conflict zones, the evolution of asymmetric technologies (drones, explosives), an ever-present media and readily available internet access to facilitate rapid reporting that reveals the carnage of war, short tours of duty that are insufficient in establishing stable long-term occupations, the decline in duration of military occupations, and the immense cost of training and maintaining soldiers. The recent retreat by American forces from Afghanistan, after thousands have died and $2 trillion+ has been expended, should be ample evidence that Galbraith is spot on with regard to U.S. military force projection.

Galbraith’s fourth and final factor is the rate of “creative destruction” in the digital technology sphere. This is destroying more jobs than it is creating, he argues. The growth-dampening effect of this “digital storm” is two-pronged, as Galbraith explains:

First, the price of the equipment required to make the new digital products—measured per unit of output—falls rapidly over time, reducing the value of business investment in the GDP. Second, the products themselves replace marketable output.

What to do about these four impediments to economic growth? This is Galbraith’s question, and his replies are as follows:

⁋ Reduce military spending.

⁋ Decentralize banking.

⁋ Regulate and reduce the size of influential financial institutions.

⁋ Strengthen existing public-insurance programs.

⁋ Temporarily lower age requirements for Social Security.

⁋ Increase the minimum wage.

⁋ Increase estate and gift taxes to reduce dynastic wealth and encourage philanthropy.

The purpose of these modest proposals is to achieve a sustainable, slow-growth economic model. Galbraith’s proposals to combat decline are at their core redistributionist in the New Deal tradition, but they are rather tame next to the New Deal Keynesians of the 20th century. The reason for this intellectual caution? Galbraith states his case clearly:

The institutional, infrastructure, resource basis, and psychological foundations for a Keynesian revival no longer exist.

From the vantage point of 2020, Galbraith’s case seems amply supported by evidence. Barak Obama, instead of ushering in a New Deal 2.0 in response to the 2008 financial crisis, bailed out Wall Street, failed to punish speculators, delivered only moderate economic stimulus, and pushed for lobbyist-friendly medical reform legislation that failed to correct the many defects of the U.S. health-care system. When Democratic Socialist Bernie Sanders ended his second presidential bid on 8 April 2020, it marked another failure to bring a program of fundamental reforms—a program intended at its core to reverse the trend toward decline—into the White House. The Covid–19 crisis, despite its severity and urgency, does not appear to be prompting any new efforts in this direction.

In Part 2 of this essay, the writer considers Peter Thiel’s analysis of decline and his case for countering it.